open-end credit meaning and example

When you purchase an item your available credit decreases. When you make payments youll be able to reuse the same credit.

How To Read A Credit Card Statement Discover

Common examples of open end credit include credit cards or home equity lines of credit.

. Open-end loans are also sometimes referred to as revolving credit. Transactions that exceed the pre-approved limit are typically declined and not processed. A consumer credit line that can be used up to a certain limit or paid down at any time Familiarity information.

Definition and Examples of an Open-End Mortgage. With open end credit you can continue making purchases and paying for them in the future as long as you continue making at least the minimum payment each month. The maximum borrowing power granted to a person from a financial institution.

Any periodic rate that may be applied expressed as an annual percentage rate using that term or the abbreviation APR. 1 n a consumer credit line that can be used up to a certain limit or paid down at any time Synonyms. Charge account credit revolving credit.

Open-end credit - a consumer credit line that can be used up to a certain limit or paid down at any time. Charge account credit account open account credit extended by a business to a customer charge card charge plate credit card plastic a. Common examples of open-end credit are credit cards and lines of credit.

Open-ended accounts have pre-approved credit limits that allow you to carry an outstanding revolving balance at any given time. You must pay a low minimum balance by the due date. OPEN-END CREDIT used as a.

Closed-end credit includes debt instruments that are acquired for a particular purpose and a set amount of time. The borrower can make frequent and repeated transactions up to that credit limit. A type of revolving account that permits an individual to pay on a monthly basis only a portion of the total amount due.

2262a20 Open-end credit means consumer credit extended by a creditor under a plan in which. Also called bank line credit line. One of the reasons why an open-end credit is preferred is that it makes money available to borrowers if and when it is needed.

An open-end loan also sometimes referred to as open-end credit is a form of borrowing that can be used up to a certain limit before it must be repaid. Line of credit denotes a limit of credit extended by a bank to a customer who can avail himself or herself of its full extent in dealing with the bank but cannot exceed this limit. An arrangement for borrowing from a bank where money can be taken and paid back up to an agreed.

Triggered Terms 102616 b. An open-end mortgage is a unique type of home loan in that the borrower has the opportunity to use the funds from the loan as needed even after they purchase the property. However by establishing an open-end credit account with a limit of at least 500 the consumer would save the additional 159 annually in premiums assuming no transaction costs to opening the account would only need to exercise the credit option in the event of a loss and could extend the repayment over three years or more.

Ii The creditor may impose a finance charge from time to time on an outstanding unpaid balance. 17 Open end credit means credit extended under a plan in which a creditor may permit an applicant to make purchases or. As you repay what youve borrowed you can draw from the credit line again and again.

With closed end credit you cannot add to what you have borrowed. Closed-end credit on the other hand is a. A line of credit generally arranged before the funds are actually required provides flexibility for the customer in that it ensures the ability to meet short-term cash needs as they arise.

A secured open-end loan is a line of credit thats secured by or attached to a piece of collateral. In contrast to more traditional loans which are given. Membership or Participation Fees.

If the plan provides for a variable rate that fact must be disclosed. Open-end credit is a type of credit in which the lender extends credit to a borrower up to a certain credit limit. A credit arrangement in which a financial institution agrees to lend money to a customer up to a specified limit.

Depending on the product you use you might be able to access the funds via check card or electronic transfer. The borrower is able to withdraw indefinitely until the limit is met. Closed end credit is different because it doesnt allow you to continue using the same credit.

A secured credit card and home equity line. For purposes of this regulation unless the context indicates otherwise the following definitions apply. Consumer credit - a line of credit extended for personal or household use.

Definition and Example of an Open-Ended Account. Charge account credit account open account - credit extended by a business to a customer. It most frequently covers a series of transactions in which case.

I The creditor reasonably contemplates repeated transactions. You must make payments on the loan until the interest and principal are paid off. Generally it is uneconomical and expensive for a borrower to borrow money repeatedly every two or three months and repay it fully.

Like a traditional mortgage loan it gives the borrower enough cash to purchase a home. Most credit cards are unsecured meaning no deposit or collateral are. This type of Consumer Credit is frequently used in conjunction with bank and department store credit cards.

At the end of the term defined by the lender the lender will send an invoice or bill to the borrower. OPEN-END CREDIT noun The noun OPEN-END CREDIT has 1 sense. What does open-end credit mean.

Open end loan can be borrowed multiple times. WAC 162-40-041 is the relevant regulation and it defines the term open end credit as follows. Advantages of Open Credit.

Charge account credit revolving credit Types.

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

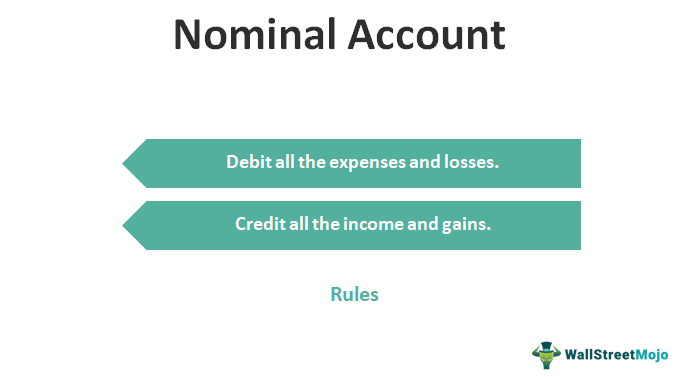

Nominal Account Rules Examples List Nominal Vs Real Account

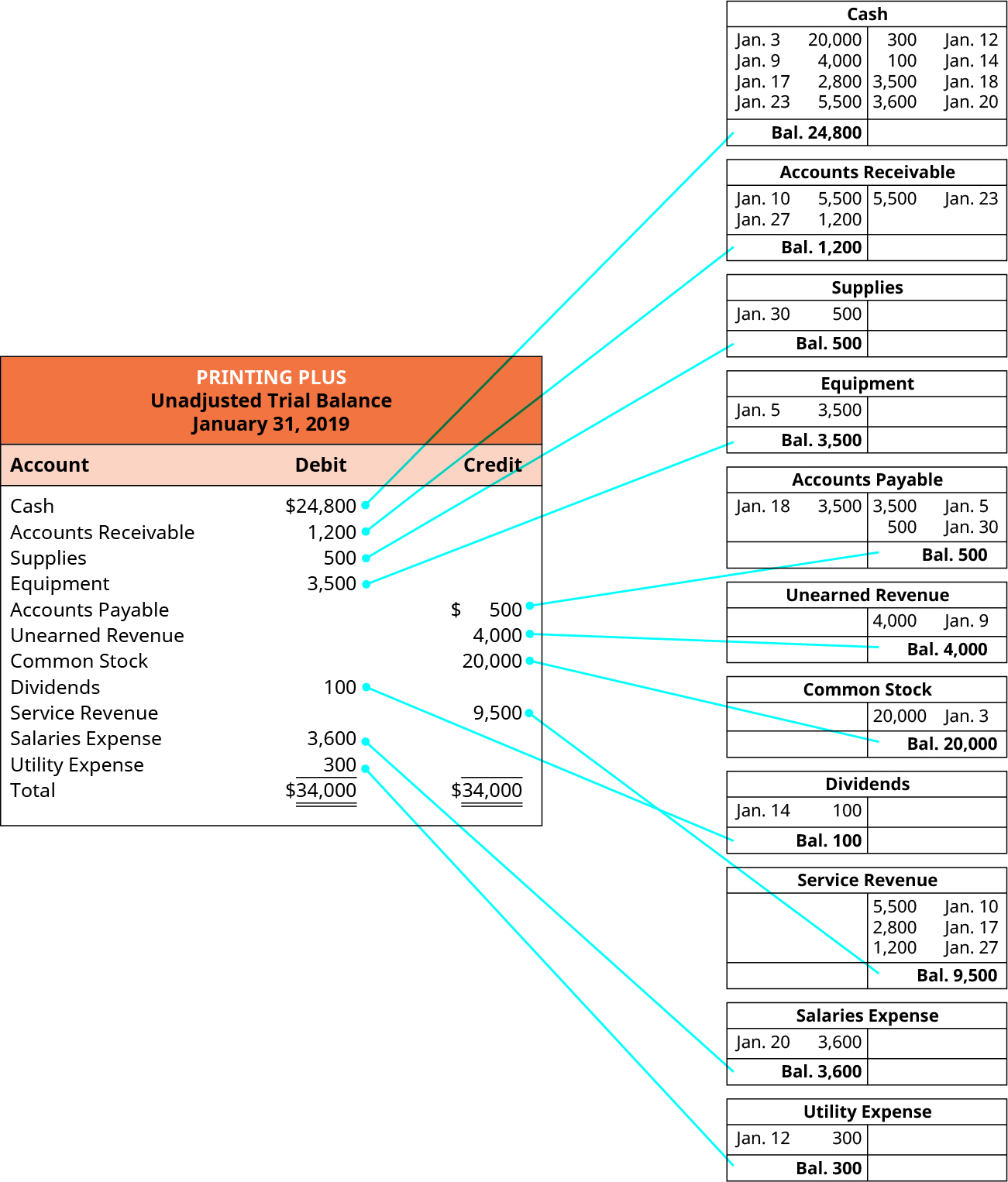

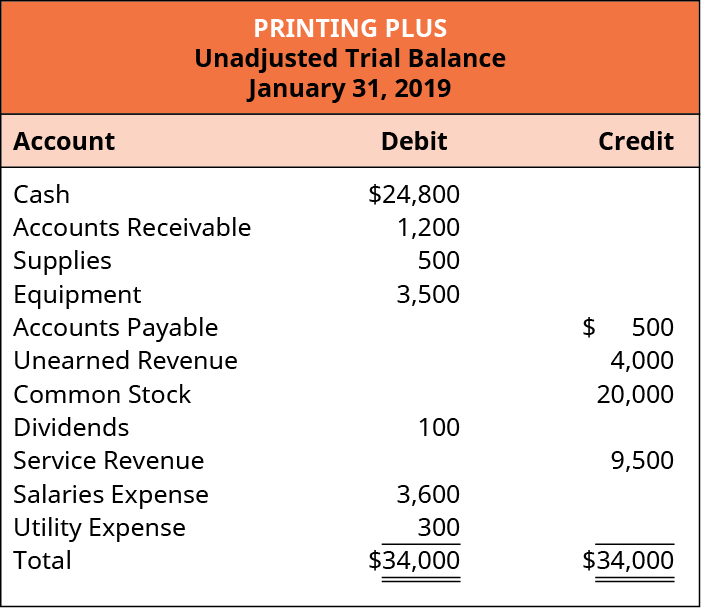

Prepare A Trial Balance Principles Of Accounting Volume 1 Financial Accounting

Sales Journal Entry Cash And Credit Entries For Both Goods And Services

Prepare A Trial Balance Principles Of Accounting Volume 1 Financial Accounting

Revolving Credit Vs Line Of Credit What S The Difference

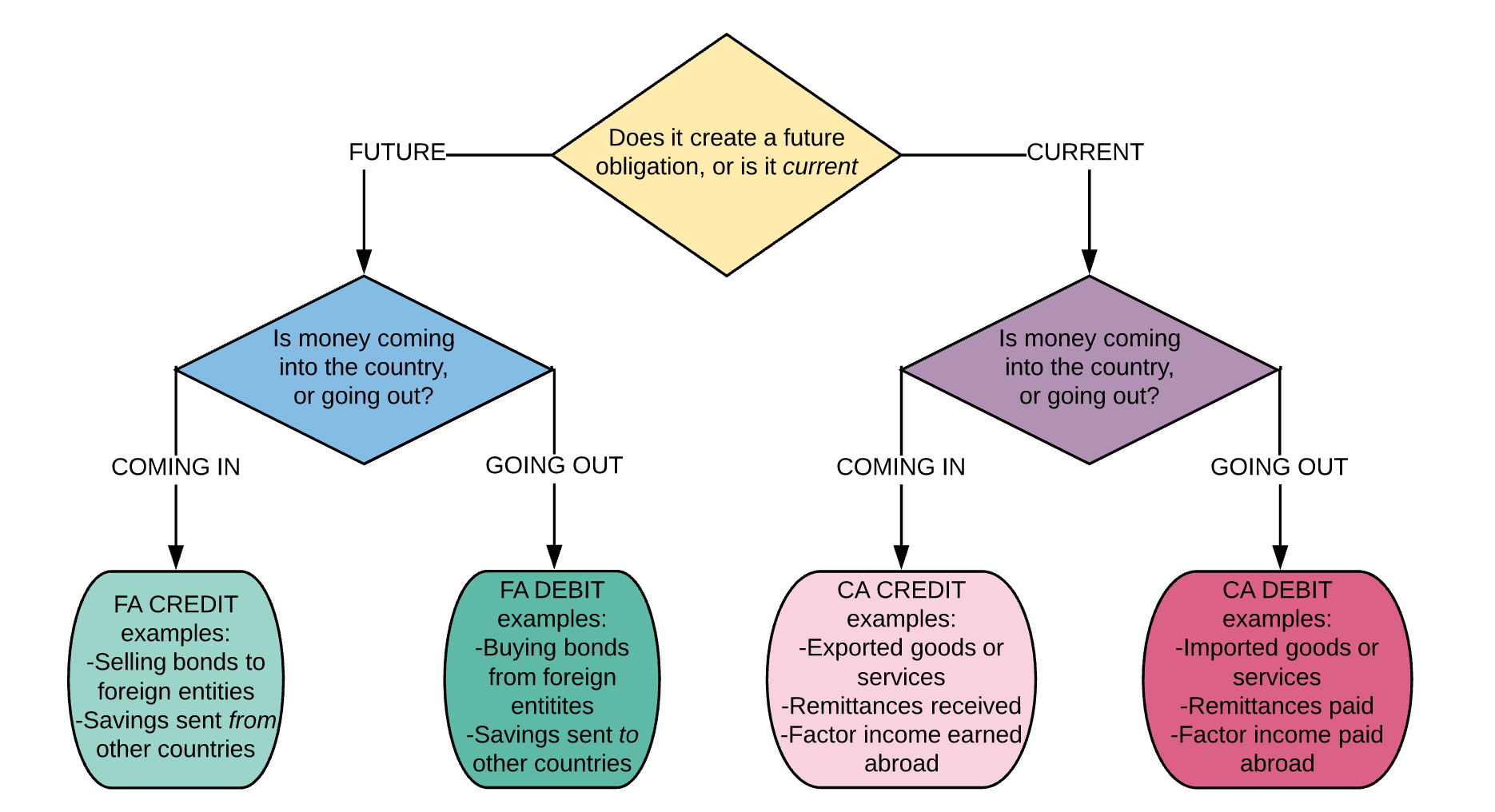

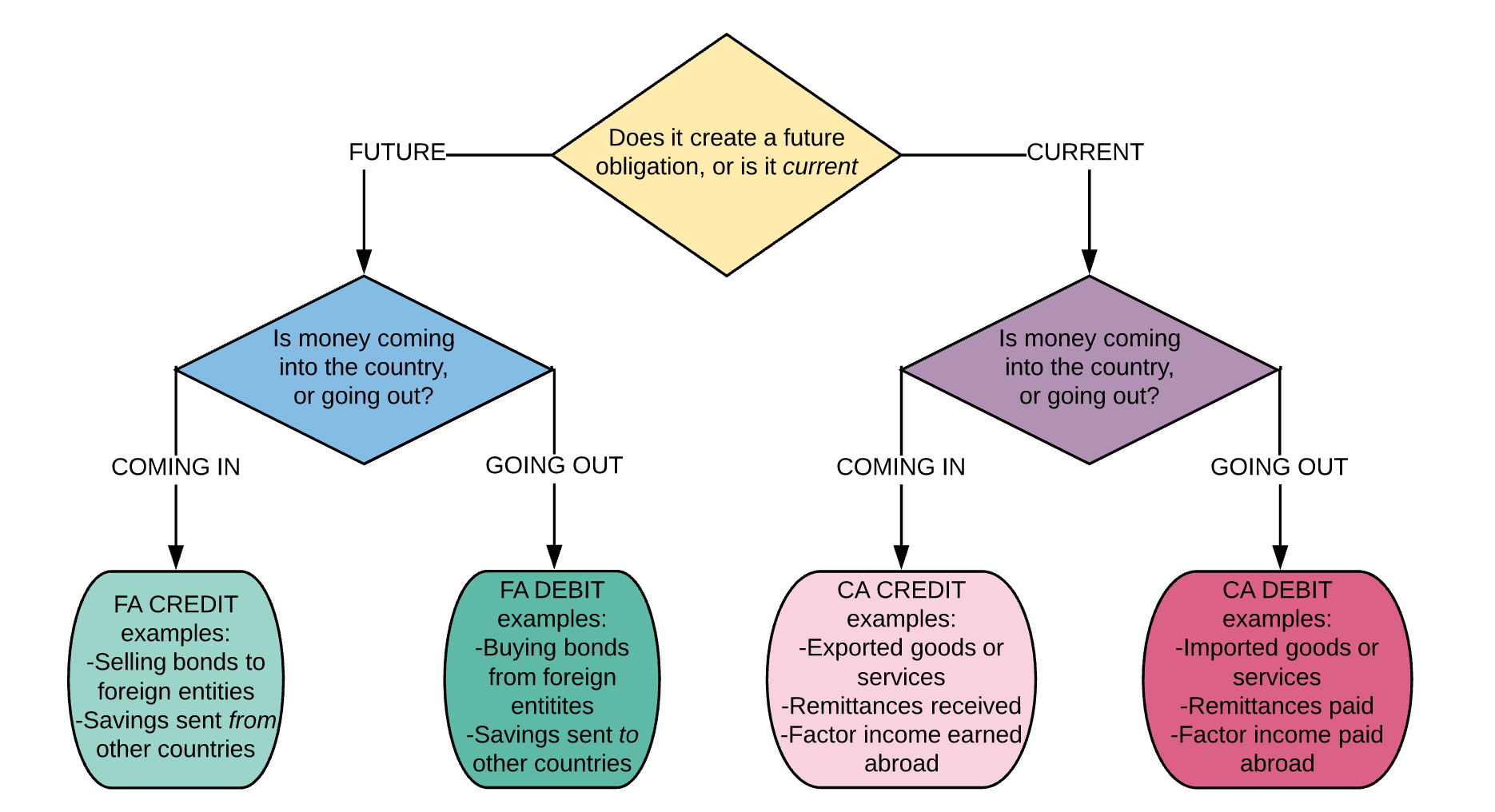

Lesson Summary The Balance Of Payments Article Khan Academy

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

Understanding Different Types Of Credit Nextadvisor With Time

What Is A Credit Utilization Rate Experian

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

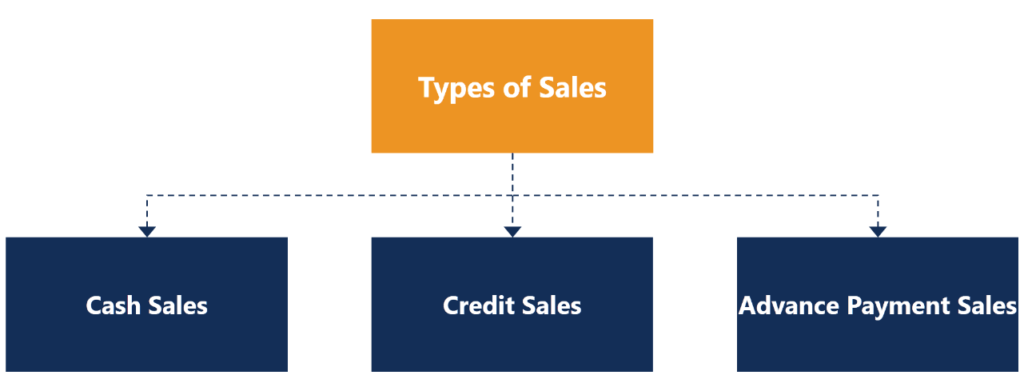

Credit Sales How To Record A Credit Sale With Credit Terms

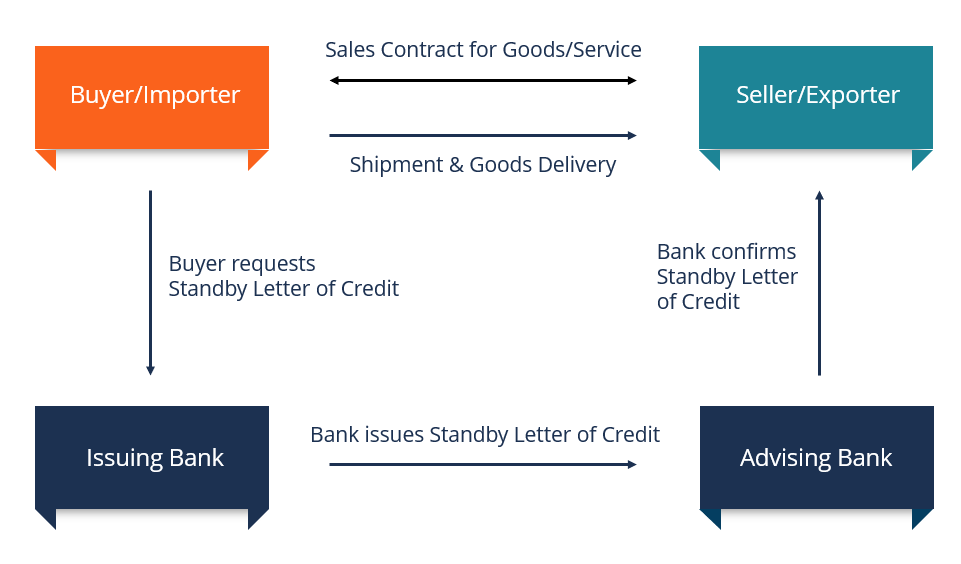

Standby Letter Of Credit Sblc Overview How It Works Types

What S The Difference Between Credit Debit Cards Huntington Bank

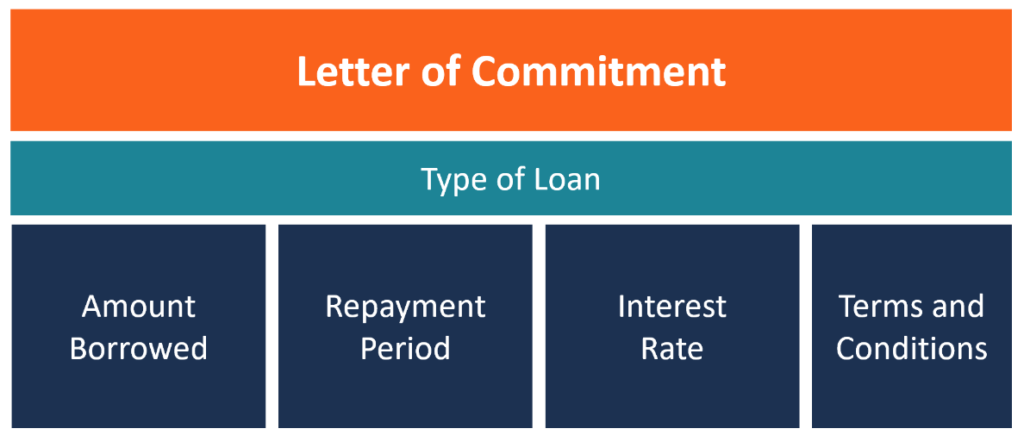

Letter Of Commitment Overview Example And Contents

:max_bytes(150000):strip_icc()/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

The Essential Music Video Credits Format Guide With Free Template

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)