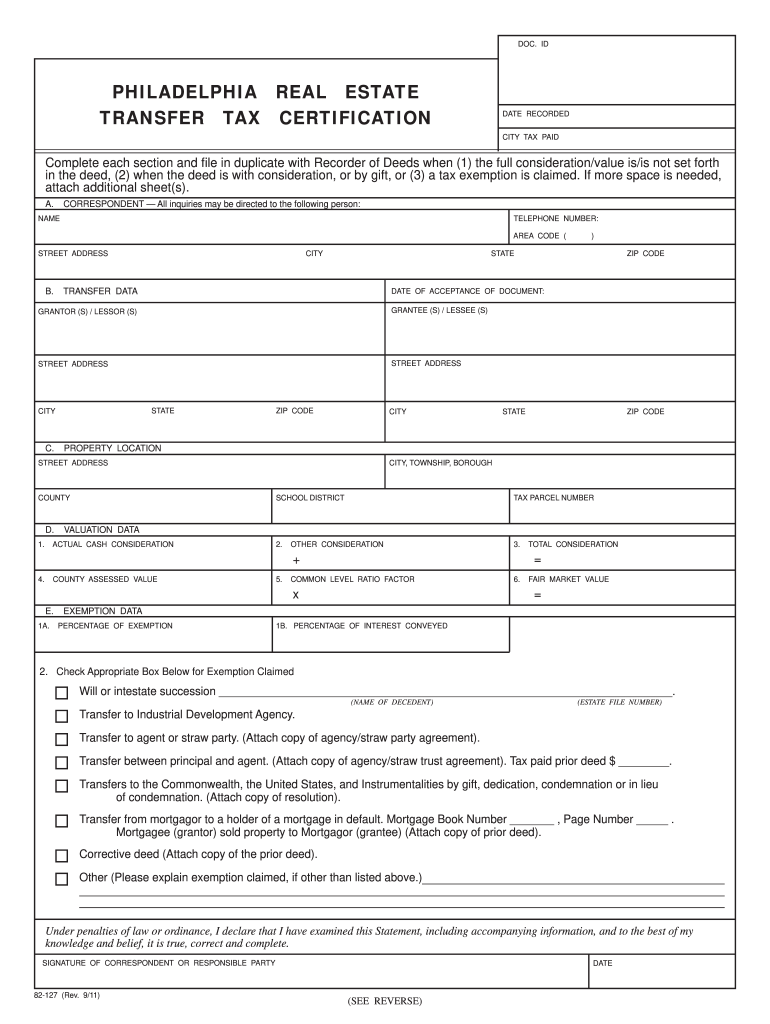

philadelphia transfer tax form

Httpswwwphilagovservicespayments-assistance-taxesproperty-taxesrealty-transfer-tax Actual Cash Consideration is what you paid for the home. Realty Transfer Tax The Commonwealth of Pennsylvania collects 1 while the City of Philadelphia collects 3278 for a total of 4278.

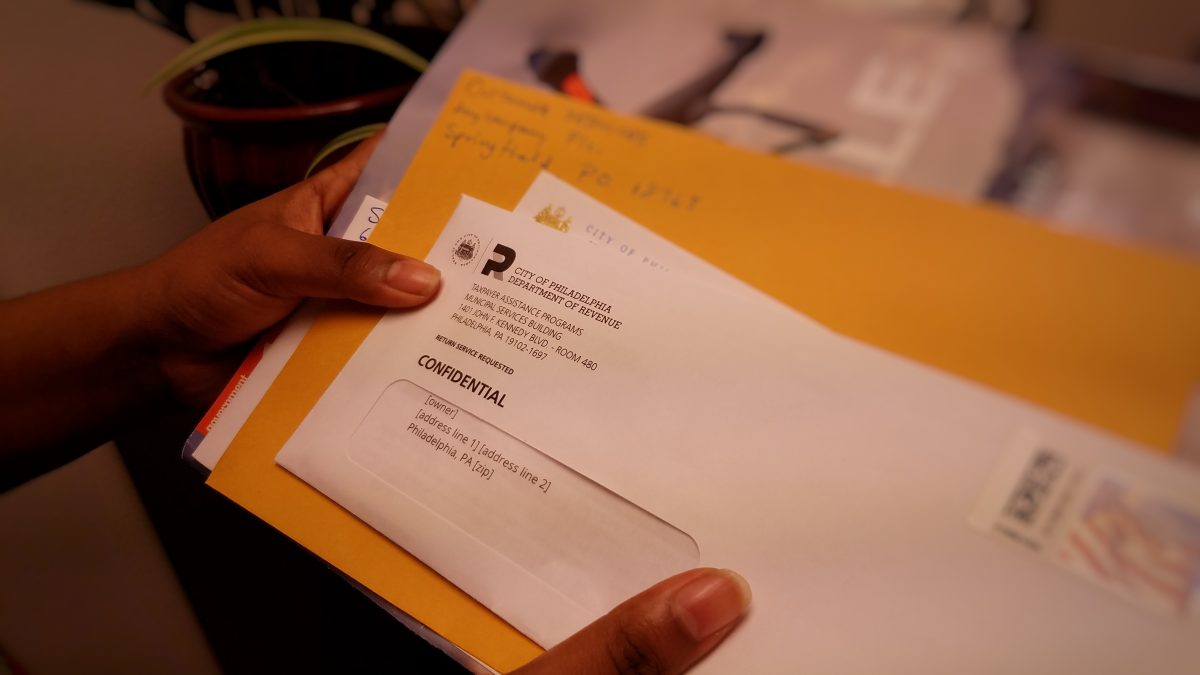

City Of Philadelphia Extends Property Business Tax Deadlines Department Of Revenue City Of Philadelphia

911 DATE SEE REVERSE INSTRUCTIONS FOR COMPLETING.

. Find the formats youre looking for Philadelphia Real Property Transfer Tax here. These forms must be fully completed. The way to complete the Philadelphia form transfer taxsignNowcom 2011-2019 online.

PA Realty Transfer Tax and New Home Construction. The above example assumes the buyer and seller evenly split the realty transfer taxes. For comparison Montgomery County Pennsylvanias transfer tax is only 1.

This property is exempt from any relevant local or special taxations. Use this step-by-step guideline to complete the Philadelphia form transfer taxsignNowcom 2011-2019 quickly and with excellent precision. Find the formats youre looking for Philadelphia Real Estate Transfer Tax Form here.

Philadelphias transfer tax is one of the highest rates within Pennsylvania. This link will take you to a sales tax table with an 800. Transfer to a Trust A transfer for no or nominal consid-.

Example Philly Transfer Tax Form A copy of this form is available for download on the City of Philadelphias website. Pennsylvania Realty Transfer Tax 3750. To begin the form utilize the Fill Sign Online button or tick the preview image of the blank.

REV-1651 -- Application for Refund PA Realty Transfer Tax. The Philadelphia Real Estate Transfer Tax Certification form is required in duplicate. Hit the Get Form Button on this page.

Hit the Get Form Button on this page. Ad Download Or Email Form 82-127 More Fillable Forms Register and Subscribe Now. This transfer tax is traditionally split between the buyer and the seller with each.

If no sales price exists the tax is calculated using a formula based on the property value determined. Revenue Code Chapter 91 -- Revenue Code - Chp 91. If you take an interest in Fill and create a Philadelphia Real Estate Transfer Tax Certification - City Of Philadelphia heare are the steps you need to follow.

A wide range of choices for you to choose from. Fill Sign Philadelphia Form Transfer Tax 1993. Title Insurance 3750.

Under penalties of law or ordinance I declare that I have examined this Statement including accompanying information and to the best of mydetermine the taxable value of real estate for all non-arms length transactions leases and acquired companies The factor isbase on the common level ratio. The correct payees for each are as follows. Edit Sign Send Philadelphia Form Transfer Tax 2011 2019.

Philadelphia Real Estate Transfer Tax Download PDF Philadelphia beginning July 1 2017 will begin to tax transfers of interests in real estate entities based on the selling price of the entity rather than the computed value assessed value102 of the realty. Effective october 1 2018 the transfer tax for the city of philadelphia is 3278 with an additional state of pennsylvania tax of 1 for a total of 4278. REV-183 -- Realty Transfer Tax Statement of Value.

Payment of City Transfer Tax State Transfer Tax and Recording Fees must be made by separate checks. Enter the date on which the deed or other document was accepted by the Partyies. Home Inspection 500.

You should be aware that typically there are both state and local transfer taxes associated with this type of transaction in addition to recording fees. Complete each section and file in duplicate with Recorder of Deeds when 1 the full considerationvalue isis not set forth in the deed 2 whenUnder penalties of law or ordinance I declare that I have examined this Statement including accompanying information and to the best ofthe deed is with consideration or by gift or 3 a. SIGNATURE OF CORRESPONDENT OR RESPONSIBLE PARTY 82-127 Rev.

A wide range of choices for you to choose from. Each deed requires separate transfer tax checks. You can erase text sign or highlight of your choice.

How is Philadelphia transfer tax calculated. INSTRUCTIONS FOR COMPLETING PHILADELPHIA REAL ESTATE TRANSFER TAX CERTIFICATION Section A Correspondent. Provide the name of the decedent and estate file number in the space provided.

The Guide of finalizing Philadelphia Real Estate Transfer Tax Certification - City Of Philadelphia Online. In most cases the buyer will pay 2139 and the seller will pay 2139. Enter the name address and telephone number of party completing this form.

Pennsylvania imposes a 1 transfer tax on the value of the real estate being transferred while Philadelphia imposes a 3278 tax on the value of the real estate being transferred. Wait in a petient way for the upload of your Philadelphia Real Estate Transfer Tax Bcertificationb. Homeowners Insurance 2200.

2 rows When you complete a sale or transfer of real estate that is located in Philadelphia you must. 2 x 100000 2000. The city of Philadelphia has an 800 percent sales tax rate which is made up of 600 percent Pennsylvania state sales tax and 200 percent Philadelphia County sales tax.

State Statement of Value Forms when required. REV-1728 -- Realty Transfer Tax Declaration of Acquisition. Luckily it is customary but not legally required for the buyer and seller to split the transfer taxes evenly.

Philadelphia transfer tax form real estate. REV-715 -- Realty Transfer Tax Monthly Report. Loan Origination.

Philadelphia Realty Transfer Tax 12293. Appraisal Fee 600. Even if you inherited the home you must write something in.

Section B Transfer Data. If you are curious about Customize and create a Philadelphia Real Estate Transfer Tax Bcertificationb here are the easy guide you need to follow. THIS STATEMENT MUST BE SIGNED BY A RESPONSIBLE PERSON CONNECTED WITH THE TRANSACTION.

Ance on the Realty Transfer Statement of Value form. A statewide list of the factors is available at the Recorder of Deeds office in each county. Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a total of 4278.

Will or Intestate Succession A transfer by will for no or nominal consideration or under the intestate succession laws is exempt from tax.

2011 2022 Form Pa 82 127 Philadelphia Fill Online Printable Fillable Blank Pdffiller

44 Taxes We Pay As Residents Of The Great City Of Philadelphia Philadelphia Magazine

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Philadelphia Cream Cheese 2 500 G Costco

10 Complaint Letter Samples Word Excel Pdf Templates Letter Templates Free Letter Templates Lettering

Philadelphia Original Cream Cheese 3 X 250 G Costco

Black Gold Series Kicks Off As A Year Long Initiative In February Mayor S Office Of Public Engagement City Of Philadelphia

Check The Po Box Mailing Tax Payments Forms To Revenue Department Of Revenue City Of Philadelphia

Deciding Where To Retire Affects Both Your Lifestyle And Your Wallet During Retirement Part Of Successfully Planning Your Tax Deductions Tax Refund Tax Return

Philadelphia Regular Cream Cheese 1 5 Kg Costco

Irs Installment Agreement Chicago Il 60647 Mm Financial Consulting Inc Chicago Internal Revenue Service Lettering

2 Trillion Stimulus Deal Reached 19 Things You Need To Know About Your Check Money Template Ways To Get Money Payroll Template

2011 2022 Form Pa 82 127 Philadelphia Fill Online Printable Fillable Blank Pdffiller

Pin By Colleen Mcclain On Passport Tax Refund Money Template Payroll Template

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Philadelphia Phillies On The Forbes Mlb Team Valuations List

United Bank Of Philadelphia Review Black Owned Low Minimum Deposits